DIGITIMES Asia – April 2025 – The superposition effect of geopolitical backflow and technological breakthrough.

The global e-distribution ecosystem in 2025 will be dominated by three disruptive forces:

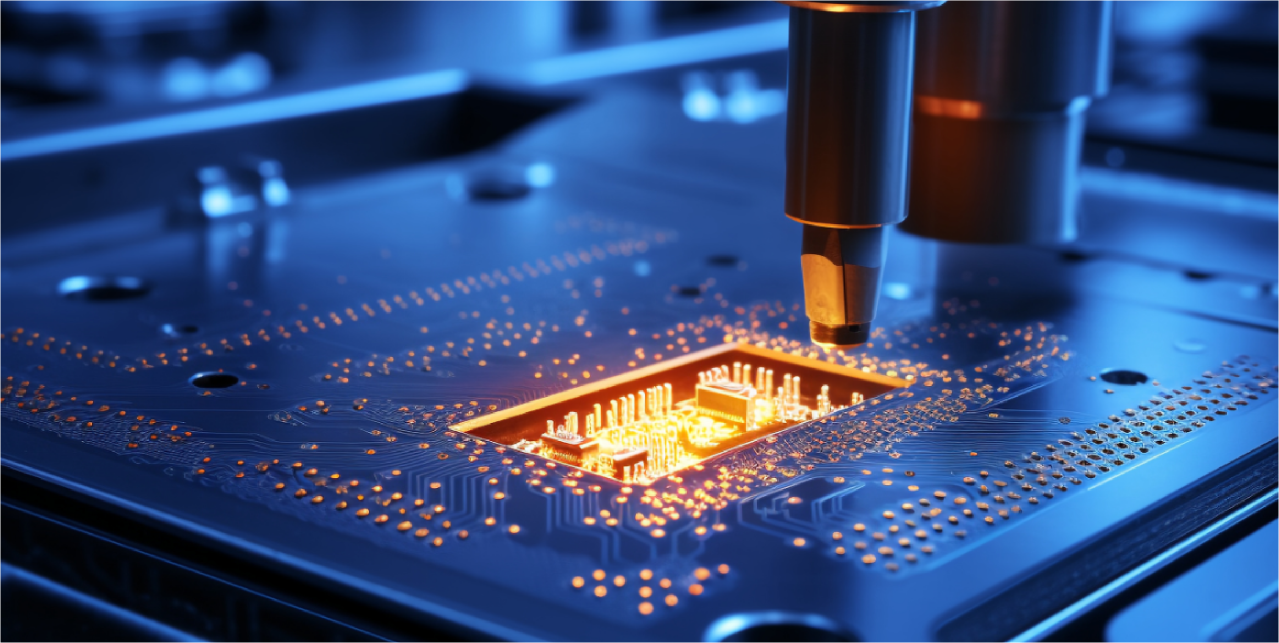

1. Ultra-growth market: AIoT (42% penetration) and new energy vehicles (68% surge in production) drive component demand.

2. Supply Chain disruption: 3nm yield issues and CoWoS capacity gaps created a $12 billion supply gap.

3. Technology inflection point: edge computing, silicon carbide application and small chip architecture reconstruction procurement strategy.

Market Dynamics Analysis

1.AIoT segment: Smart homes dominate (63% share), industrial sensors grow by 29% year over year ;

Edge AI processor wafer demand to grow by 2.1 times from 2024.

2. Automotive electronics: Penetration rate of 800V sic solution in high-end electric vehicles reaches 61% ;

Infineon/ON Semiconductor order backlog till 2026.

There is now a sense of urgency that we must do

1. Deploy a real-time supply chain visualization platform

It is necessary to establish a full-link digital monitoring system covering raw material procurement,

production logistics and inventory management, and realize dynamic tracking of transnational

supply chain through Internet of Things sensors and blockchain technology to cope with the risk of

sudden supply interruption caused by geopolitical conflicts.

2. R&d budget is invested in alternative technical solutions

Focus on developing alternative technology routes such as chiplet heterogeneous integration and

silicon photonic interconnection, and reserve funds for redundant supplier certification of

key equipment (such as EUV lithography machines) to reduce strategic vulnerability

caused by dependence on a single technology path.

3. Dual-source procurement of key components (such as ST/TI microcontrollers) :

to avoid material shortage and production interruption.

4. Hierarchical inventory mechanism: state of emergency (< 4 weeks) ;

Launch of futures contract + Level 2 procurement alert status (4-8 weeks) ;

Priority auto/Medical allocation safety stock (> 8 weeks) ; Build a 5% buffer reserve.